With the orientation of becoming a modern industrial province by 2030 (According to the Binh Phuoc Provincial portal), Binh Phuoc province is promoting investment incentives for businesses, especially for Industrial production. On that basis, on January 31, 2022, the People’s Committee of Binh Phuoc province passed a Resolution providing for policies on investment encouragement, incentives and supports in Binh Phuoc province. The issuance of the above resolution creates a great attraction for industrial development in Binh Phuoc in general and in Viet Kieu Industrial Park in particular. The resolution has set the tax incentives applicable in Binh Phuoc in general and Viet Kieu Industrial Park will be clearly stated in this article

1. Corporate Income tax Incentives at Viet Kieu Binh Phuoc Industrial Park

According to Resolution No. 01/2022/NQ-HDND issued on March 31, 2022, Binh Phuoc province imposed 4 years of corporate income tax exemption; 50% tax reduction for the following 9 years and 10% tax rate for the first 15 years, applicable to many Investment Incentive industries.

Enterprises outside the group of Investment incentives industries with are still offered with incentive of 2 years of corporate income tax exemption; 50% tax reduction for the following 4 years and 15% tax rate for the first 10 years.

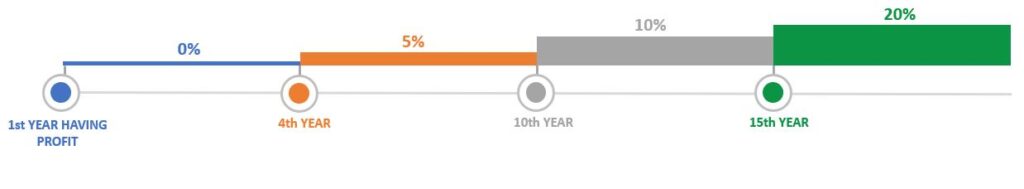

FOR Investment Incentive industries IN bINH pHUOC

Pursuant to Clause 9, Article 3, Chapter I of Resolution No. 01/2022/NQ-HDND dated March 31, 2022 on promulgating regulations on investment promotion, incentive and support policies in the locality. Binh Phuoc province stipulates as follows:

Investors work in Investment incentive industries and locate their factories at Hon Quan, Chon Thanh, Dong Phu, Phuoc Long, Binh Long district can be offered with corporate income tax incentive as below:

- Tax rate: 10% within the first 15 years, 20% for remaining period.

- Exemption and reduction of tax: tax exemption for 4 years, tax reduction of 50% for the next 10 years.

- Tax exemption and reduction period: Calculated continuously from the first year when having taxable income, in case there no taxable income in the first three years, from the first year when the revenue is generated from new investment project, tax exemption and reduction period is calculated from the fourth year.

Investment incentive industries Binh Phuoc include:

- Enterprises applying high technology are given priority for development investment under the Prime Minister’s decision.

- Manufacturing biotechnology products.

- Producing composite materials, light building materials.

- Processing and preserving agricultural, forestry and fishery products, processing non-timber forest products.

- Invest in, research and produce biotechnology products for use as food.

- Manufacture of wooden products; production of artificial boards, including: plywood, jointed boards, MDF boards.

- Producing raw materials for medicine and drugs.

- Producing energy-saving products.

- Manufacture of pharmaceutical chemicals, basic chemicals and rubber.

- Manufacture of automobiles and auto parts.

- Manufacture of electronic components and accessories.

- Producing machines, tools, equipment and spare parts for agriculture, forestry, fishery production, food processing machines.

- Producing and processing minerals as building materials.

- Producing and processing animal and aquaculture feeds.

- Producing pesticides and organic fertilizers, biological products.

- Production of handicrafts.

- Manufacture of environmental monitoring equipment, on-site wastewater treatment equipment.

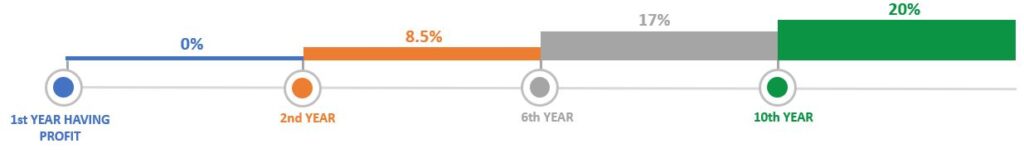

TAX INCENTIVE FOR OTHER INDUSTRIES IN BINH PHUOC

Pursuant to Clause 2, Article I, Appendix V of Resolution No. 01/2022/NQ-HDND dated March 31, 2022, tax incentives for enterprises not in the group of industries eligible for investment incentives are regulated as follows

- Tax rate: 17% within the first 9 years, 20% for remaining period.

- Exemption and reduction of tax: tax exemption for 2 years, tax reduction of 50% for the next 4 years.

- Tax exemption and reduction period: Calculated continuously from the first year when having taxable income, in case there no taxable income in the first three years, from the first year when the revenue is generated from new investment project, tax exemption and reduction period is calculated from the fourth year.

2. Import tax Incentives

Preferential import tax: Import tax exemption in accordance with the Law of Import Export No. 107/2016/QH13 dated 06/4/2016 and Decree No. 134/2016/NĐ-CP dated 01/9/2016 of the government.

Tiếng Việt

Tiếng Việt 中文 (中国)

中文 (中国)